The shocking truth about the Euro

Shock, horror. The euro has now fallen well below the U.S. dollar. A chocolate euro now costs more than the real coin is worth. As Zimbabwe abandoned the local dollar and went over to the multi-currency system in 2009, the euro became legal tender. But shops don’t want it, they don’t see it often, the girls at the checkout hold it up and say: what’s this then? They want the U.S. or South African rand or Botswana pula. Don’t even think about offering Chinese yuan, also legal tender.

I have a few euros in a tea caddy in the kitchen. When I put them there they were worth euro 1.48 to a single U.S. dollar. Now it’s around euro 0.93 to $1. Thank goodness I am a poor retiree and not a euro millionaire. I already cry at the euros evaporating in the kitchen. Who should I blame? The Greeks? Quantative easing (printing more money) by the European Central Bank? The Americans and the price of oil, conflagration in the oil fields of Syria and Iraq?

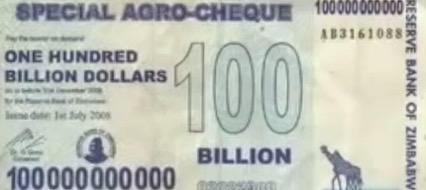

Not so worthless after all:

The Zimbabwe Reserve Bank did do quantative easing itself until the switch to multi currencies, and worsened matters by slicing off zeros at the stroke of statutory instrument, willy nilly. Look where that got us. World record inflation of billions of percent, worse than the Third Reich and Argentina ever were; at a restaurant you could pay when you ordered from the menu or when you finished eating, with hourly inflation thrown in…

Our money came in suitcase loads for American dollars on the black market.

One of our curious notes. It was not actually a cheque, it was currency.

We don’t think the ECB will be shedding zeros from the euro anytime soon. Phew, that’s a relief, but I am still crying about the current state of my few euros.

The exchange rate is the lowest in 11 years. When the euro came into being then, Jacques Delors, Europe’s French financial guru, said he had his doubts it would ever be a great success. The British stayed out, the Irish joined the eurozone, their economy is on the mend now, but southern Europe – Greece, Italy, Spain and Portugal – are battling to fight austerity and runaway unemployment.

A German aid agency in Harare gave its managers a 2.5 percent salary increase in January. But effectively their euro salaries in recent months diminished by 30 percent against the U.S. dollar – the benchmark for most transactions and purchases here. They are crying more than I am.

What if our top-heavy, greatly bloated civil service took a 30 percent pay cut? It would help the exchequer enormously. What if the Pope decreed everyone could use condoms? Unlikely too.